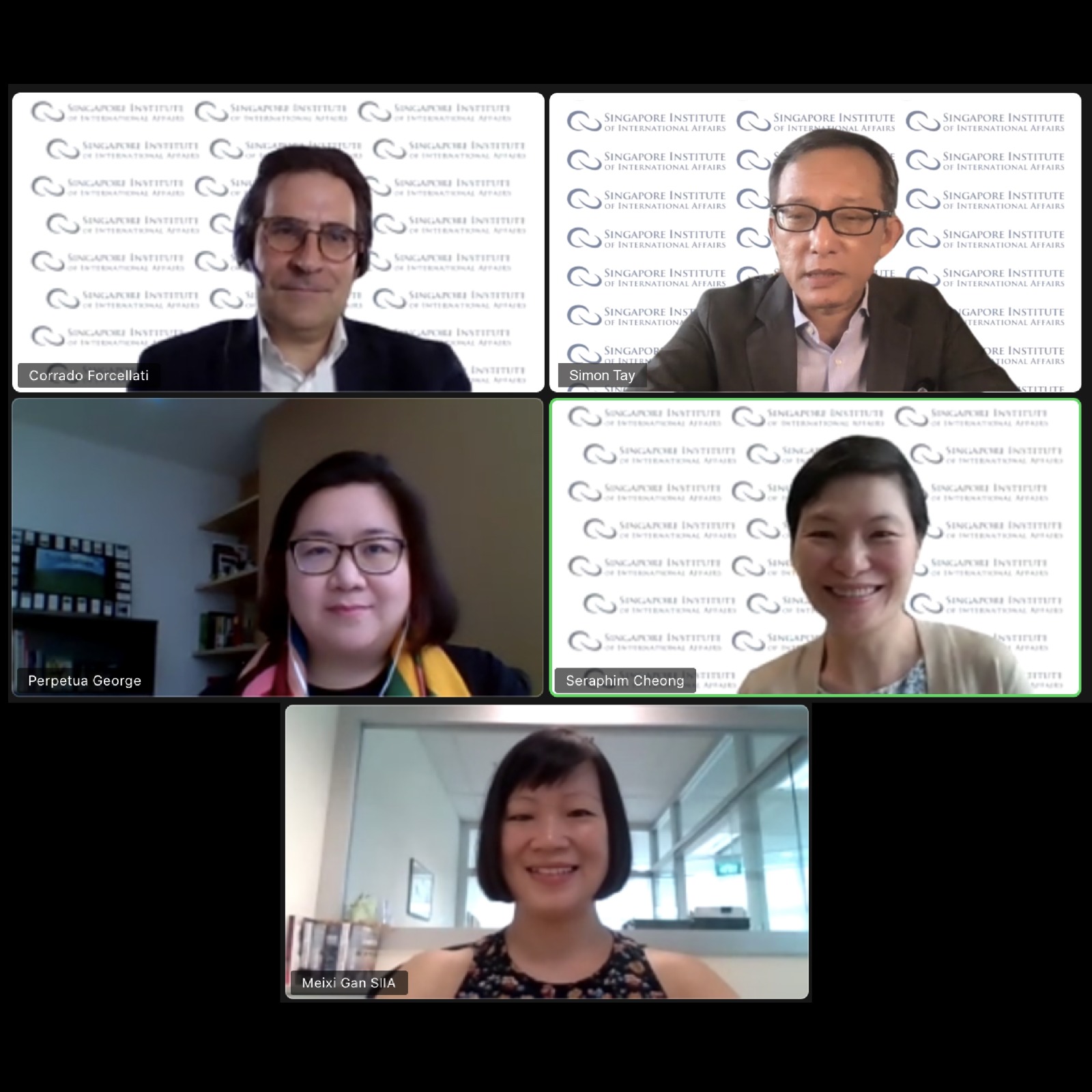

There is strong emerging interest in environmental, social and governance (ESG) issues in ASEAN, accelerated by the COVID-19 pandemic. Climate change as an issue is now at the fore of public consciousness, and corporates are pushed to be drivers of solutions to environmental and social challenges. The Singapore Institute of International Affairs (SIIA) hosted a webinar on 8 October 2020, on “How ASEAN’s corporate sector is rising to the sustainability challenge in an uncertain world”. Moderated by Associate Professor Simon Tay, Chairman of the SIIA, the webinar featured speakers Mr. Corrado Forcellati, Director of Sustainability Services at KPMG Singapore, and Ms. Perpetua George, General Manager for Group Sustainability at Wilmar International.

ASEAN corporates are quickly embracing ESG

More companies in ASEAN are building dashboards and machine learning intelligence to create more transparency within their sustainability practices – something not commonly seen in this region until fairly recently, with the exception of certain sectors such as agribusiness. The agribusiness sector has long been linked to fires and haze in the region. In response, companies within the sector have had to pay extra attention to ESG. Over the years, leading companies have been putting stronger policies in place to protect nature, monitor greenhouse gas emissions resulting from their operations, and improve the livelihoods of communities where they operate. As such, most major players in the agribusiness sector of today have comprehensive and robust sustainability measures.

Riding on the momentum brought about by COVID-19, the trend of embracing ESG is likely to continue, as companies across all sectors engage future opportunities to align sustainability and business priorities.

Challenges in reporting ESG: avoiding box-ticking exercises

There are, however, challenges within the ESG landscape, and one example is the overwhelming amount of information requests, frameworks and standards that companies have to comply with. Although not always mandatory, corporates strive to comply with these standards because sustainability is increasingly viewed as a basic requirement in business. The multitude of standards and frameworks, however, makes it exceedingly hard to make ESG reporting more than a “box-ticking” exercise for corporates, and this has been especially evident since the advent of COVID-19.

Take for example the palm oil sector, where demands for sustainability by consumers and NGOs alike meant that companies have been dealing with ESG since the early 2000s. Even prior to COVID-19, major international companies already had sustainable practices pertaining to the environment, supply chain and labour force worked into their operations. The ESG reporting frameworks, however, were not ready for COVID-19, and have scrambled to incorporate COVID-19 related elements such as questions on social sustainability. As many companies’ efforts in these areas pre-date COVID-19, they may not translate easily to the exact phrasing or criteria that indices and ratings agencies now require.

Rather than focusing on whether companies’ ESG practices “tick the boxes”, ratings agencies and ESG frameworks should look beyond reporting and toward actual implementation of sustainability commitments. Many companies that have implemented ESG commitments over the years have built up their knowledge of what ESG factors are material, even if those factors do not necessarily match up with what indices or ratings frameworks want. Looking at the industry’s implementation of ESG more closely may thus help make reporting easier and more meaningful.

Other challenges in embracing ESG

Other pertinent challenges to advancing ESG include the need to engage with smaller companies and have them understand the value of ESG, and ensuring the quality of data used to facilitate ESG verification. ESG ratings will be more widely accepted when ESG data can be verified accurately and audited, the same way financial data is currently verified, evaluated and compared. To this end, efforts such as the European Union’s “green taxonomy” will be helpful. In addition, with the rise in attention to social sustainability during COVID-19, there will be a need to better measure, and hence value, the social aspect of ESG.

Do we play “to win” or “not to lose”?

In a post-COVID world, corporates should embrace ESG and consider whether they are playing the ESG game to win, or merely playing not to lose. It is no longer enough for companies to take a defensive approach to ESG; they must be incentivised do more, to create positive impact as well as a competitive edge for themselves. Winning at ESG means moving beyond box-ticking exercises, identifying sector and company-specific ESG priorities, and looking closely at whether their implementation of ESG achieves them. Improving the quality of data disclosures will also help to align the industry with external stakeholders such as rating agencies.

To read more on this topic, the SIIA will be releasing a report which highlights material ESG practices in the agribusiness and forestry sectors, and details recommendations to help align stakeholders’ ESG expectations. The report will be published in November 2020.